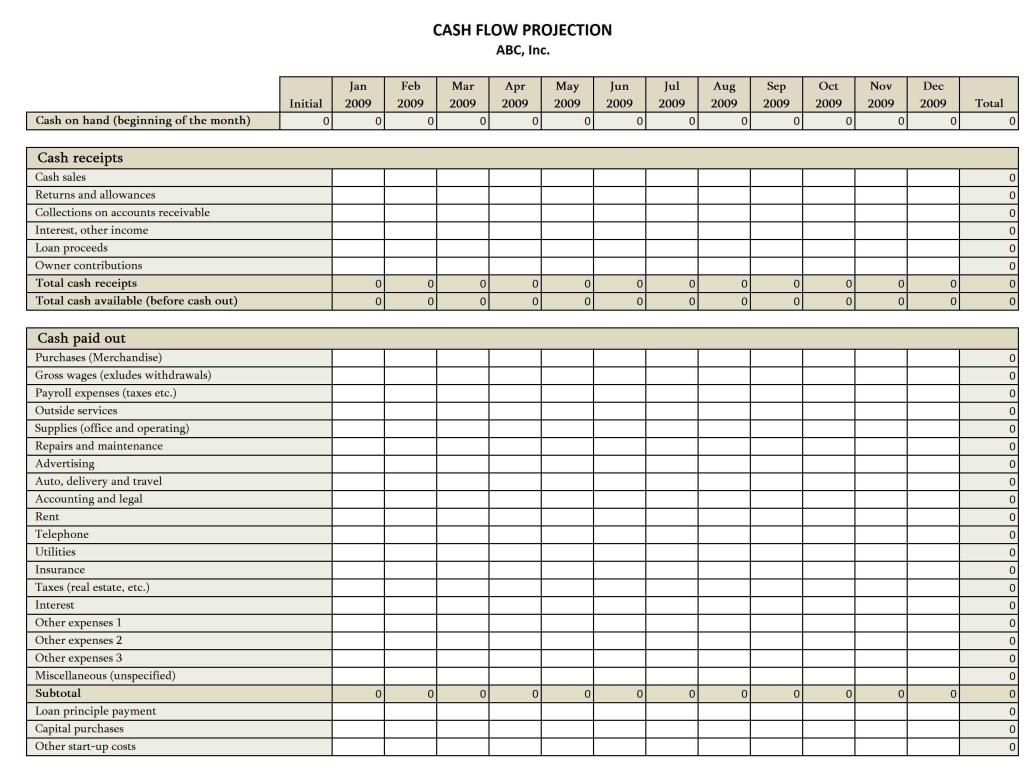

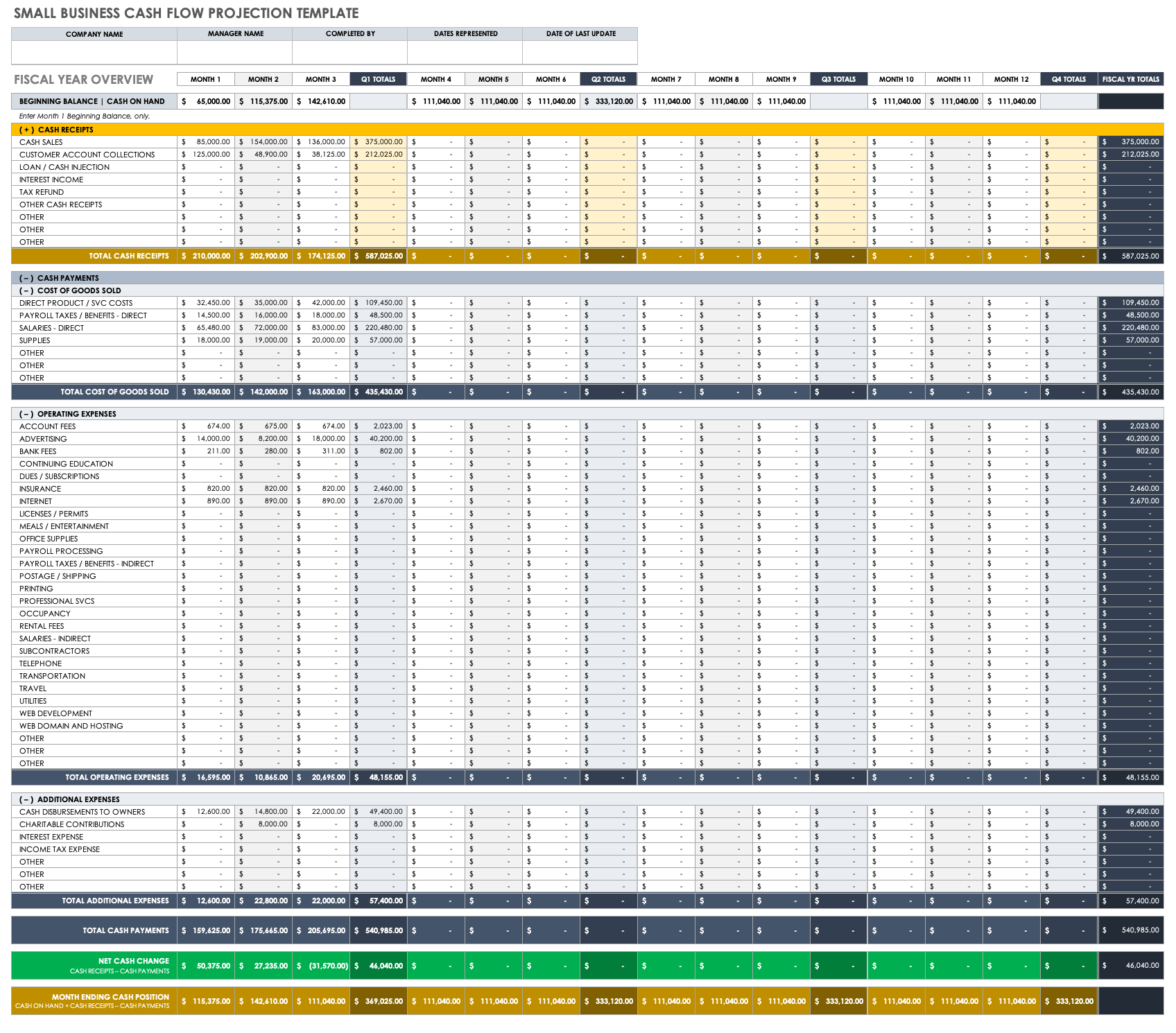

Cash flow statements reflect a company’s balance of cash and cash equivalents at the beginning and end of the reporting period. For instance, rather than recreating a year-to-date cash flow every month, it’s easier and usually more accurate to simply add up all of your monthly cash flows up to that point of the year. Disbursements under the direct method include cash what is the difference between supplies and materials for bookkeeping paid to suppliers for goods, cash paid to employees for services, and cash paid to creditors for interest and tax payments. This method deducts cash out from cash in by focusing on cash inflows and cash outflows of cash from operating activities. In order to fill out a cash flow statement easier, you will need your most recent income statement and balance sheet.

Investing Activities

- Alternatively, you can easily create a cash flow statement based on an accounting system such as QuickBooks.

- The Vertex42 Template Gallery for Sheets add-on has a variety of professionally designed documents and spreadsheets ready to be used.

- Add any cash receipts from goods (for a product-based company) or services (for a service-based company).

- We won’t be so bold to say cash flow worksheets are like snowflakes or a ten-minute drum solo, but we probably don’t have to.

You can track down your expenses and handle the necessary and unnecessary ones. You can show the outflow or expenses using a negative sign (-), and this will also reflect in the calculations. This means that you don’t have to have 2 separate tables, and you can summarize your cash flow easily. Positive cash flow is seen when the incoming money is more than the outgoing money, while negative cash flow indicates that more money is leaving than entering, almost like profit and loss. The formulas used for the column totals are set up to make it easy to add and delete rows without messing up the template, as long as you insert new rows within the range of rows referenced by the totals.

Monthly Cash Flow Template Google Sheets

There are a variety of templates available for Google Sheets, each one has different features that meet the needs of specific business objectives. Let’s take a look at the templates available to take your cash flow management to the next level. Sage Intacct has 150 built-in financial reports enabling you to easily create custom reports and leaving you with more time to focus on your business and prepare your financial statements. IFRS requires companies to disclose cash flow from discontinued operations either in the cash flow statement or in its notes. They reflect revenue and expenses accrued during a reporting period, including non-cash accounting like depreciation and amortization. They reflect cash paid and received, revealing how much cash a company has on hand at the end of a reporting period.

Operating Activities

Use formulas like SUM to calculate the total inflows, outflows, and net cash flow for each period. Depending on your business needs, you can extend these forecasts weekly, monthly, or yearly. This powerful tool allows you to break down your monthly income and expenses, track your cash flow, and make informed decisions about your financial health. It provides sections for various sources of income and outflows, including payroll, business expenses, debts, living expenses, and savings. Always be on the lookout for reclassifications or changes in your income statement or balance sheet classifications.

Keep tabs on your company’s cash flow to monitor the health of the business — no accounting software, just spreadsheets. Use this spreadsheet-based cash flow system to combine payments and receipts data from across your company and create an automated cash flow monitor that’s always up to date. It helps you calculate your total cash upfront and the gross monthly rent you could earn from your property. It deducts all potential expenses such as property insurance, taxes, management fees, a sinking fund, and more to provide you with the net operating income. The Restaurant Cash Flow Template from Live Flow is a meticulously designed Google Sheets template that serves as a comprehensive financial guide for restaurant owners.

Download our cash flow template for Excel and read about how to prepare a cash flow statement and the differences between direct and indirect method. Income or expenses in foreign currencies can easily skew your cash flow worksheet with exchange rates that you fail to account for properly. When inflows or outflows differ from your reporting/functional currency, accurate cash flows quickly get lost in translation or, more accurately, lost in a lack of translation.

In this cash flow template Google Sheets guide, we will explore various cash flow templates available, highlighting their features. See how easy it is to track and manage your cash flow statement with a template in Smartsheet. Creating a Monthly Budget that is the same each month requires that you use averages for variable expenses (fuel, food, etc.) and periodic expenses (insurance, tuition, subscriptions, etc.). A yearly cash flow analysis like this one can help you figure out what those averages are. The Sheetgo cash flow template is a workflow of connected spreadsheets that exchange data between them. The template concludes with the achievement of a business’s enterprise value along with implied multiples, giving investors a clear picture of the company’s worth.

The indirect method can be used to create the statement of cash flows from the information in the balance sheet and income statement, but I’ll leave that explanation for the textbooks. To create a cash flow statement manually, select a time period and review your income and expenses in each of the three activities discussed above. Use a self-created spreadsheet or download our excel cash flow template to organise your data into a cash flow statement.

This advanced model combines cash flow projections with an optional analysis of line credit. Use a cash flow statement as well as cash flow projections to clarify your company’s position on cash. If you have any concerns about creating or understanding your cash flow statement and projections, work with a CPA or other knowledgeable financial specialist. Download this cash flow statement template no matter what type of business you have.

You should still verify the formulas used for the Totals if you insert rows. The template concludes with the net increase or decrease in cash over the period, providing the beginning and ending cash balances. And thanks to color-coded sections for when your cash flow is positive or negative, you can easily spot trends and make necessary adjustments. A unique feature is the ability to visualize each category as a percentage of your total income or expense, enhancing your understanding of where your money is coming from and where it is going. Make sure you have a good understanding of where your money comes from and when, and where your money is spent in meeting your financial obligations.

It has a simple format that is easy to understand and not too crowded but still enough to detail all your finances. Cash flows are often mistaken for business expense sheets, but these are 2 different things. On the other hand, a business expense spreadsheet only shows the expenses and sometimes a small summary of the income. The spreadsheet contains two worksheets for year-to-year and month-to-month cash flow analysis or cash flow projections. A cash flow analysis is not the same as the business budget or profit and loss projection which are based on the Income Statement.

НОВОСТИ

НОВОСТИ Half-Life

Half-Life Half-Life 2

Half-Life 2