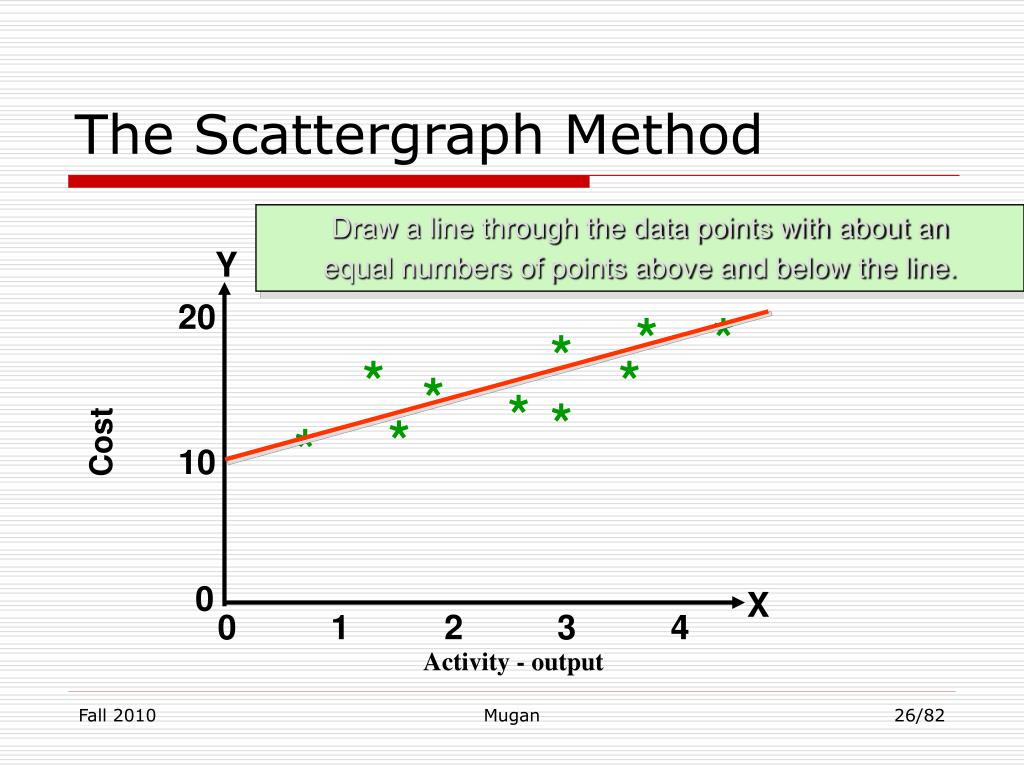

For example, you want to show a connection between consuming sugar and weight. You could plot this on a scatter plot, with one axis representing the amount of sugar each person consumed during a specific time period. The other axis may represent the pounds gained or lost during that time.

Steps in Performing the Scatter Graph Method

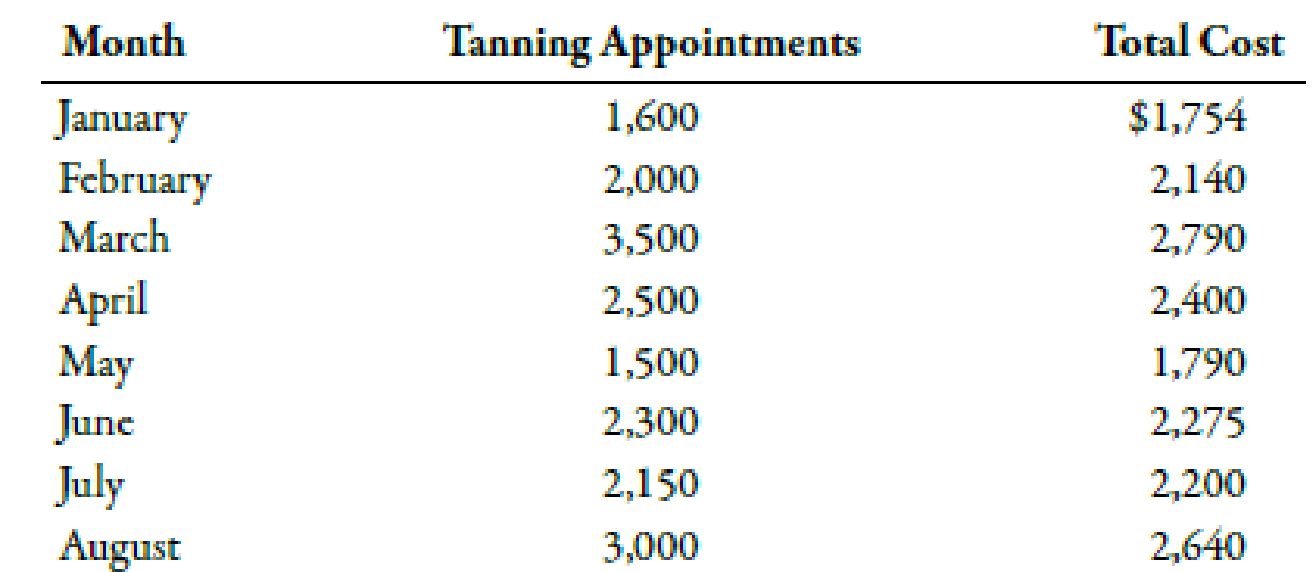

In this case, it would be February and May, as shown in Figure 2.33. We always choose the highest and lowest activity and the costs that correspond with those levels of activity, even if they are not the highest and lowest costs. Creating a scattergraph begins with the collection of relevant data. This typically involves gathering historical cost information and corresponding activity levels over a specific period.

Exploring Variable Costs

For instance, one point will represent 21,000 hours and $84,000 in costs. The next point on the graph will represent 23,000 hours and $90,000 in costs, and so forth, until all of the pairs of data have been plotted. Finally, a trend line is added to the chart in order to assist managers in seeing if there is a positive, negative, or zero relationship between the activity level and cost. Learn how to effectively use the scattergraph method for cost accounting to identify and analyze fixed and variable costs.

- The scatter graph method is used to segregate mixed costs and is more accurate than the high-low method.

- The other axis may represent the pounds gained or lost during that time.

- Another important aspect of the scattergraph method is the identification of outliers.

- The line is drawn using our best judgment and a bit of guesswork, and the resulting yintercept (fixed cost estimate) is based on this line.

- The intercept of this line on the vertical axis represents the fixed costs.

- The scatter graph method is done visually by plotting the data points on a graph.

Cost Function

Using this information and the cost equation, predict Waymaker’s total costs for the levels of production in Table 2.12. It is evident from this information that this company has very little in fixed costs and relatively high variable costs. This is indicative of a company that uses a high level of labor and materials (both variable costs) and a low level of machinery (typically a fixed cost through depreciation or lease costs).

Steps to Construct a Scattergraph

To determine the variable cost per unit, all costs identified as variable are totaled and divided by the measure of activity (units produced is the measure of activity for Bikes Unlimited). One of the fundamental concepts behind the scattergraph method is the distinction between fixed and variable costs. Fixed costs remain constant regardless of activity levels, while variable costs fluctuate in direct proportion to changes in activity.

Examples of when to use a scatter plot

When interpreting a scatter graph, it is important to remember that different people would likely draw different lines, which would lead to different estimations of fixed and variable costs. No one person’s line and cost estimates would necessarily be right or wrong compared to gross pay vs net pay another; they would just be different. Estimation is also useful for using current data to predict the effects of future changes in production on total costs. Three estimation techniques that can be used include the scatter graph, the high-low method, and regression analysis.

The accuracy of the scattergraph heavily depends on the quality and completeness of this data. Therefore, it is advisable to use a reliable accounting software like QuickBooks or Xero, which can streamline the data collection process and ensure that all necessary information is captured accurately. To demonstrate how a company would use a scatter graph, let’s turn to the data for Regent Airlines, which operates a fleet of regional jets serving the northeast United States. The Federal Aviation Administration establishes guidelines for routine aircraft maintenance based upon the number of flight hours. As a result, Regent finds that its maintenance costs vary from month to month with the number of flight hours, as depicted in Figure 2.29.

Here we will demonstrate the scatter graph and the high-low methods (you will learn the regression analysis technique in advanced managerial accounting courses. Scatter graph method is a graphical technique of separating fixed and variable components of mixed cost by plotting activity level along x-axis and corresponding total cost (i.e. mixed cost) along y-axis. A regression line is then drawn on the graph by visual inspection. The line thus drawn is used to estimate the total fixed cost and variable cost per unit.

One of the assumptions that managers must make in order to use the cost equation is that the relationship between activity and costs is linear. A diagnostic tool that is used to verify this assumption is a scatter graph. Once the data points are plotted as described in step 1, draw a line through the points touching one data point and extending to the y-axis.

Another important aspect of the scattergraph method is the identification of outliers. Outliers are data points that deviate significantly from the overall pattern. These anomalies can distort the analysis and lead to inaccurate conclusions if not properly addressed. By visually inspecting the scattergraph, accountants can easily spot and investigate these outliers, ensuring a more accurate representation of cost behavior. You can manually draw a scatter plot or create one in a program like Excel, Tableau, Visme, and Canva. If you’re learning how to use a scatter plot, drawing one by hand can help you understand how it works.

НОВОСТИ

НОВОСТИ Half-Life

Half-Life Half-Life 2

Half-Life 2