Balance sheets are usually prepared by company owners or company bookkeepers. Internal or external accountants can also prepare and accounting software xero: set up payroll review balance sheets. If a company is public, public accountants must look over balance sheets and perform external audits.

Different stocks for different objectives

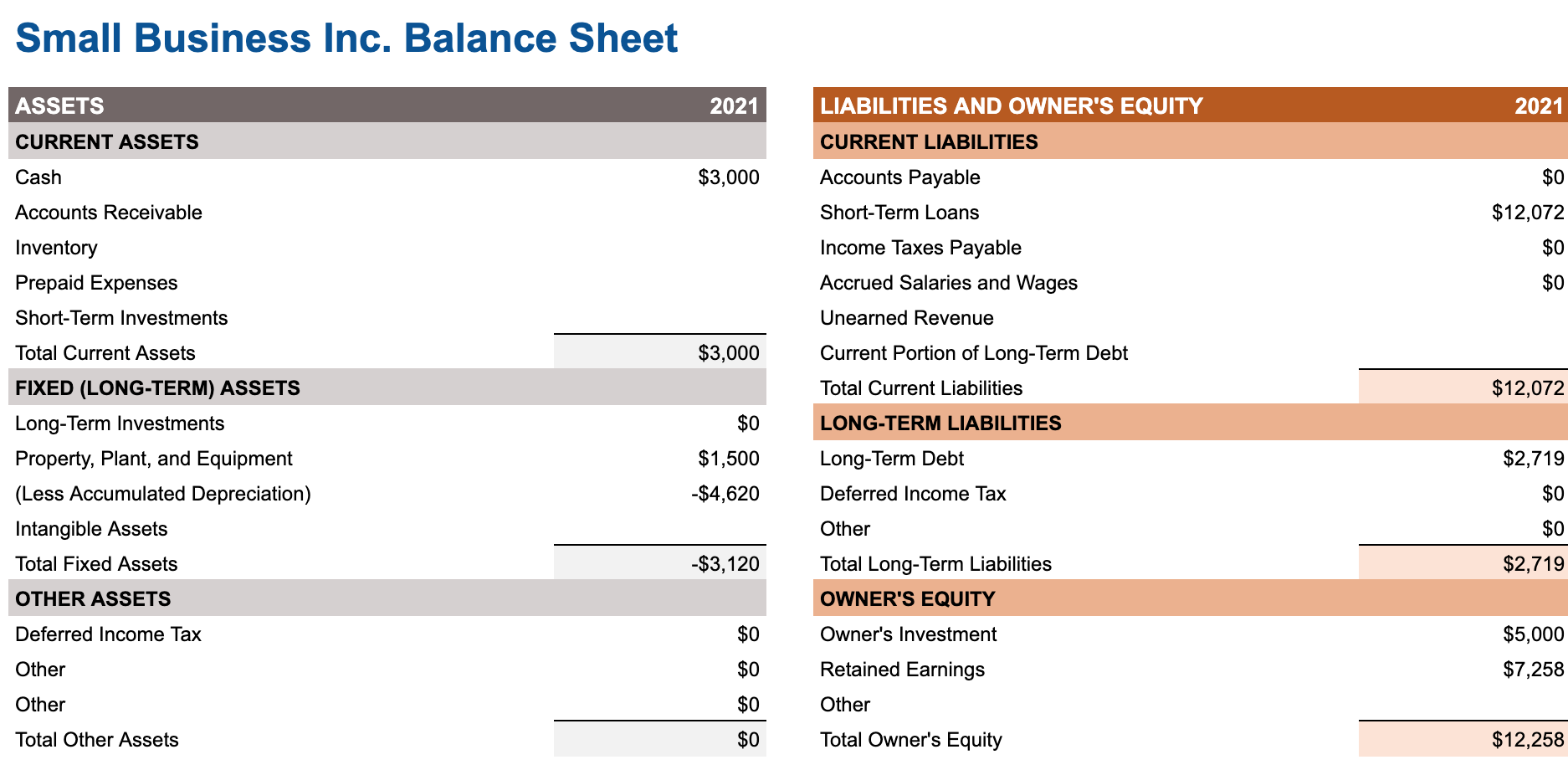

The value of each asset is in the first column, and the sum of the value of the assets in the class is in the second column, next to the last individual asset value. The assets class values are then summed similarly to develop a total of all assets (in the third column). The personal cash‐flow statement is a moving picture of someone’s personal cash inflows and outflows (Box 15.1). The cash‐flow statement examines money flows over a specific period, generally a month or a year. It is often used as the basis for developing a budget, which aims to use past income and expenditures to plan for the future.

Assets = Liabilities + Owner’s Equity

These red flags can hint at underlying operational issues or demand constraints, necessitating further investigation into sales and collection processes. Determining your business’s ability to meet current financial obligations or defining your working capital. To do this, you will need to know your company’s current ratio and days cash on hand. A balance sheet is an important financial statement that summarizes a business’s financial situation.

How to automate balance sheet reporting with QuickBooks

Balance sheets are important financial statements that provide insights into the assets, liabilities, and shareholders’ equity of a company. A company receives assets such as cash when selling a product or service, or even by selling shares of its own stock or issuing bonds. It can also use cash to purchase additional assets used for the business. In the U.S., assets are listed on a balance sheet with the most liquid items (i.e., those that are easiest to sell) listed first and longer-term assets listed lower.

- This includes debts and other financial obligations that arise as an outcome of business transactions.

- It also yields information on how well a company can meet its obligations and how these obligations are leveraged.

- In this article, we’ll explain everything you need to know about a business’s balance sheet.

- Below liabilities on the balance sheet is equity, or the amount owed to the owners of the company.

- Instead, the principal is accounted for through the depreciation of the underlying asset purchased.

To get a jumpstart on building your financial literacy, download our free Financial Terms Cheat Sheet. It’s important to note that how a balance sheet is formatted differs depending on where an organization is based. The example above complies with International Financial Reporting Standards (IFRS), which companies outside the United States follow.

Importance of balance sheets and how to use them

Our mission is to empower readers with the most factual and reliable financial information possible to help them make informed decisions for their individual needs. Our goal is to deliver the most understandable and comprehensive explanations of financial topics using simple writing complemented by helpful graphics and animation videos. Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications. Shareholders’ equity will be straightforward for companies or organizations that a single owner privately holds. Liabilities are also separated into current and long-term categories.

Analyzing balance sheets is a fundamental aspect of financial statement analysis, offering insights into a company’s financial position at a specific point in time. The balance sheet presents a snapshot of assets, liabilities, and equity, allowing investors and analysts to assess liquidity, solvency, and financial stability. By evaluating metrics such as current and quick ratios, debt-to-equity, and asset turnover, one can gauge operational efficiency and potential financial risks. Understanding balance sheet dynamics is essential for making informed investment decisions and assessing a company’s long-term financial health.

Accounts should learn how to analyze a balance sheet for the most insight. Thankfully, you can plug balance sheet information into various ratios for financial ratio analysis. Assets refer to anything a business owns that offers current or future value.

For example, if you buy a car for $40,000 and expect it to last for five years, you might depreciate it at $8,000 per year. After the first year, your car would be shown on the balance sheet at the purchase price of $40,000 minus $8,000 accumulated depreciation, for a net book value of $32,000. For the past 52 years, Harold Averkamp (CPA, MBA) hasworked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online.

НОВОСТИ

НОВОСТИ Half-Life

Half-Life Half-Life 2

Half-Life 2