However, if you’re classifying them as employees, then you miss out on this opportunity. For example, it wouldn’t make sense to hire a CPA with tax experience to manage your investment accounts. It’s difficult to keep up with all the money coming into and out of your company. Stay updated on the latest products and services anytime anywhere. At Business.org, our research is meant to offer general product and service recommendations.

There federal filing requirements might also be mismatching debits and credits or errors when transferring data from the income statement to the cash flow statement. Many small-business owners purchase items for their business from the same vendor month after month. If this is your practice, it’s a great idea to contact your vendor and build a personal relationship with them.

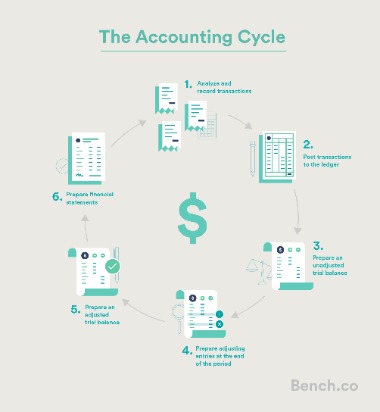

Forgetting to enter a transaction compromises your data integrity. That entry could be an employee’s salary or a budgeting item used to make an important financial decision. The initial years of a new business are extremely overwhelming, but failing to keep your books current will only make the situation worse.

Previous Post40+ Questions To Ask Your Business Accountant

- If you don’t have the time to learn this, then you should get a CPA ASAP to help you figure things out.

- Not going over your financial statements puts you in the dark, which means you’re operating blindly — not smart.

- An omission error, or a false negative, is the accounting problem of forgetting an entry like a purchase or sale.

- However, when bookkeeping is mishandled, businesses can face dire consequences, leading to financial losses, legal issues, and even the downfall of the company.

- You can avoid this situation by opening a dedicated business bank account early on.

When you look for one, make sure it includes the relevant features that you’ll need. You don’t want to overpay for features you won’t use and may not properly understand. This can obviously inflate your revenue, which will also increase the taxes you owe. That’s definitely not something you can commit to as a business owner.

Neglecting to reconcile.

Employees want to trust they will be paid correctly and on time. Too many incorrect paychecks can break trust in your accounting system or your business as a whole. In fact, a survey by QuickBooks showed that 1 in 6 small business employees said a single inaccurate paycheck would make them quit their job.

Missing Transactions:

If your books are suffering because business is booming, that’s a sure sign you need to bring on an extra hand. Costly errors will be caught more quickly, and your business operations will be more efficient in general. As previously mentioned, the IRS has little tolerance for error. If you misrepresent the amount of sales or payroll tax owed by your company, you can expect hefty fines. It’s best to leave this one to the professionals, and double- or triple-check your returns before dropping them in the mail.

Of the three errors mentioned here, the incorrect payee name on transactions is the one likely to cause the most trouble. This error can lead to incorrect reporting on Form 1099, reduce credit card processing expenses with non which can cause your vendor to be taxed on income they didn’t actually receive. You can solve and prevent data entry errors in a number of ways. The potential impact of a data entry error can vary from something minor to a major mishap, such as underpayment or overpayment of a vendor. These costly bookkeeping mistakes can happen to anyone, and at least one of them will probably happen to you at some point in your business.

A main part of the accounting process is payroll, what is an executive summary and paying your employees correctly needs to be a priority. Though uncommon with automated tools, compensation errors do happen. The potential impact of transposition errors varies depending on the entry, but they could result in a loss of funds for your business.

We don’t guarantee that our suggestions will work best for each individual or business, so consider your unique needs when choosing products and services. The right software can make bookkeeping a little easier for the average layperson. Check out our top picks for the year’s best bookkeeping software. Not only will you be making your financial life more comfortable, you’ll also be complying with the Making Tax Digital (MTD) scheme.

Ignoring Tax Deadlines:

Small-business owners often make bookkeeping mistakes in their early years of operation. This might be due to a lack of knowledge regarding proper accounting procedures. While you may not have the time, money, or desire to become a certified accountant, it is still possible to avoid a few key pitfalls that can impact your company’s bottom line. A common bookkeeping mistake is failing to collect, report, and account for sales tax. Sales tax can be a complex issue as rules differ in each state.

НОВОСТИ

НОВОСТИ Half-Life

Half-Life Half-Life 2

Half-Life 2