Similarly to ASC 840, this straight-line lease expense is calculated as the sum of all of the rent payments over the lease term and divided by the total number of periods. A full example with journal entries of accounting for an operating lease under ASC 842 can be found here. Under ASC 842, those balances are no longer on the balance sheet but are reflected as adjustments to the ROU asset balance. When rent is paid in advance of its due date, prepaid rent is recorded at the time of payment as a credit to cash/accounts payable and a debit to prepaid rent. When the future rent period occurs, the prepaid is relieved to rent expense with a credit to prepaid rent and a debit to rent expense.

Accounting for prepaid rent with journal entries

A lease expense, equivalent to the straight-line rent expense recognized under ASC 840 for operating leases, is recognized for interest accrued on the lease liability and amortization of the ROU asset. Recent updates to lease accounting, including new standards ASC 842, IFRS 16, GASB 87, and SFFAS 54, have changed the accounting treatment for some types of leasing arrangements. In short, organizations will now have to record both an asset and a liability for their operating leases.

Eliminate Lease Accounting Errors

In practice, lease payments are not typically disbursed at a constant amount, even if they are recognized in that manner. For both the legacy and new lease accounting standards, the timing of the rent payment being known is the triggering event. For example, let’s examine a lease agreement that includes a variable rent portion of a percentage of sales over an annual minimum. At the initial measurement and recognition of the lease, the company is unsure if or when the minimum threshold will be exceeded.

Accounting Treatment for Rent Payment

Record the necessary journal entry for the month ending April 2023. Before the case can be started, the landlord or someone working for the landlord, must demand the overdue rent from the tenant and warn the tenant that if the rent is not paid, the tenant can be evicted. The demand must be in writing and must be delivered to the tenant at least 14 days before the court case is started. The date of the invoice (your bill) has nothing to do with your accounting. The aggregate payments required under the lease total is $15,767,592.

How has accounting for rent payments changed under ASC 842?

The company has recorded rent expense for the first two months of the quarter but they have an accrual for the payment. A company makes a cash payment, but the rent expense has not yet been incurred so the company has prepaid rent to record. Prepaid rent is an asset – the prepaid amount can be used by the entity in the future to reduce rent expense when incurred in the future. Prepaid rent is governed by the ASC 842 rules of lease accounting.

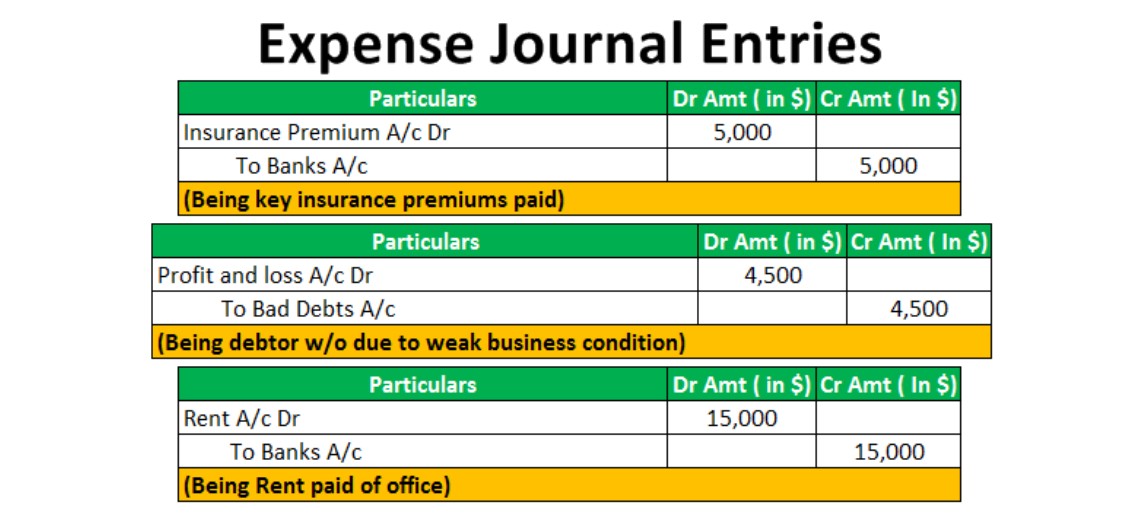

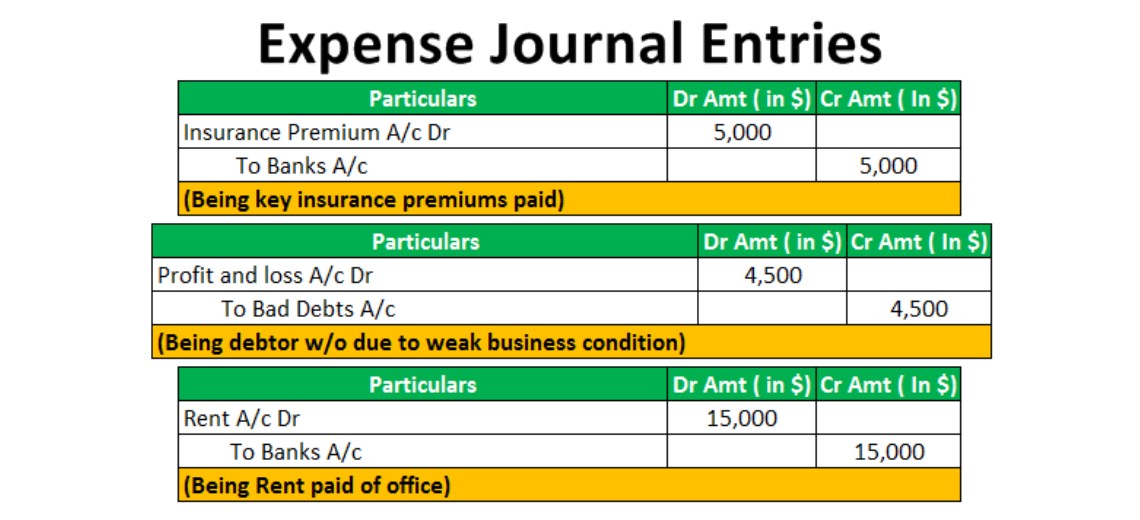

- Show related journal entries for office rent paid in the books of Unreal Corporation.

- An adjusting entry for the portion actually being applied at the end of each month.

- The tenant is paying for an expense that has not yet been incurred.

- Any business needs to pay the rent for using any commercial space or property.

Example – On 10th March, XYZ Ltd paid office rent to its landlord by cheque for the same month amounting to 20,000. Show journal entries for office rent paid by cheque in the books of XYZ Ltd. To summarize, rent is paid to a third party for the right to use their owned asset.

Since they have not yet incurred the rent expense, the company should record an asset as they will be able to benefit in the future. The independent contractor invoice template will be a debit to the Rental Liability which is already recorded above and credit to the Bank GL. When an advance payment for the rent is made by the entity, the prepaid rent account is debited and the cash account is credited as mentioned in the example earlier. Rent is treated usually as an expense but in this scenario, it is an asset. Sometimes a business does not own any specific type of property, plant, and/or machinery. They take the required asset on rent and pay the pre-specified installment for the asset in terms of cash or cheques.

Our lease accounting software automates the majority of the lease accounting process, making this complicated necessity quicker, more accurate, and more compliant. When an advance payment for rent is made it becomes an asset as it will generate an economic value in the future for the organization. This is done to keep legal evidence of the accounting transaction and maintain an audit trail. If the lease payment is variable the lessee cannot estimate a probable payment amount until the payment is unavoidable. Even if a high certainty the performance or usage the variable lease payment is based on will be achieved does exist, the payments are not included in the lease liability measurement.

ABC & Co. has paid rent accounting for $2,000 in advance (prepaid) for 5 months. The cash account will be credited (reduced) and the prepaid rent account will be debited (increased) by $2,000. The party receiving the rent may book a journal entry for the rent received. The periodic lease expense for an operating lease under ASC 842 is the product of the total cash payments due for a lease contract divided by the total number of periods in the lease term. If all details of a contract are the same, organizations record the same amount for lease expense under ASC 842 as they would for rent expense under ASC 840.

НОВОСТИ

НОВОСТИ Half-Life

Half-Life Half-Life 2

Half-Life 2