The price-to-book ratio may not be as useful when evaluating the stock of a company with fewer tangible assets on its balance sheets, such as services firms and software development companies. However, a high book value per share could also indicate a lack of re-investment. A company that fails to reinvest its earnings might have a high book value from accumulated earnings, but this could potentially harm future growth. High book value without reinvestment could indicate stagnation or lack of strategic planning. Therefore, investors typically prefer companies that balance between maintaining high book value and reinvesting for growth.

No Consideration for Future Growth Potential

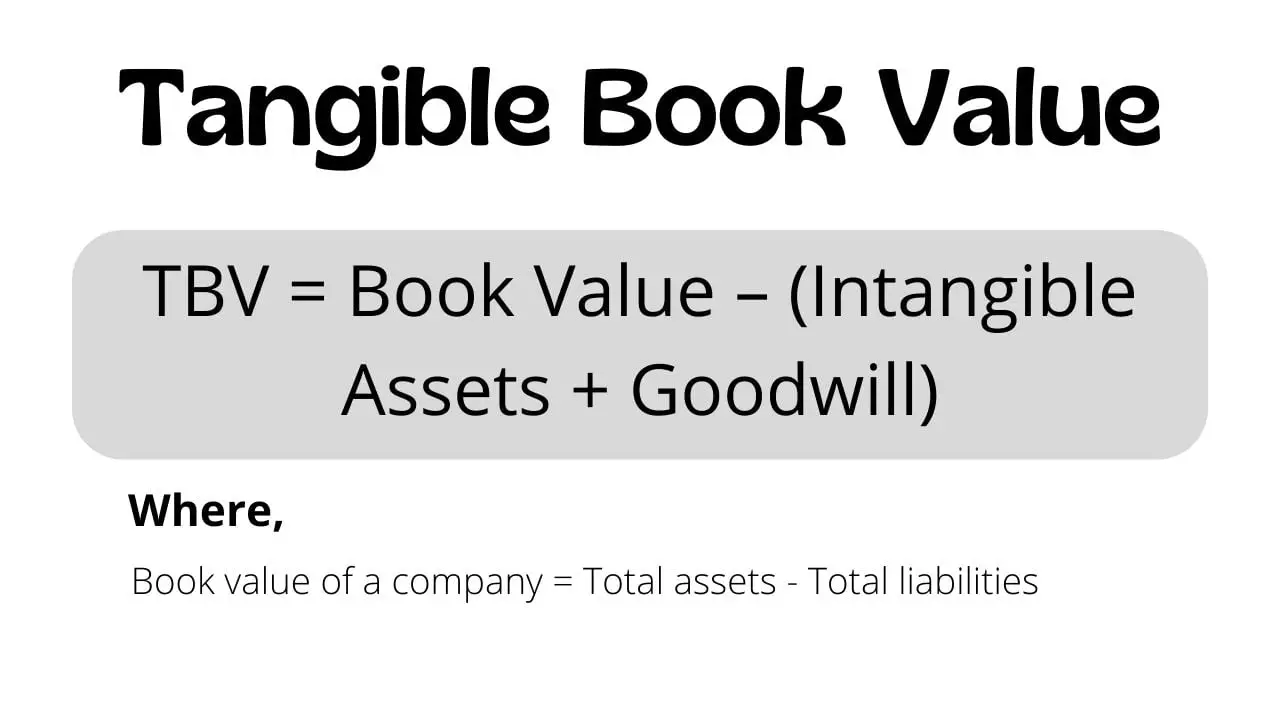

- Book value per share is a reflection of a company’s total tangible assets minus its total liabilities.

- Clear differences between the book value and market value of equity can occur, which happens more often than not for the vast majority of companies.

- The book value per share is just one metric that you should look at when considering an investment.

- The price-to-book (P/B) ratio considers how a stock is priced relative to the book value of its assets.

Inversely, if a company does not pay dividends and retains its profits, it may result in an increased book value per share, as those retained earnings will add to the net assets of the company. It depends on a number of factors, such as the company’s financial statements, competitive landscape, and management team. Even if a company has a high book value per share, there’s no guarantee that it will be a successful investment. This is why it’s so important to do a lot of research before making any investment decisions. There are a number of other factors that you need to take into account when considering an investment.

P/B Ratios and Public Companies

The company generates $500,000 in earnings and uses $200,000 of the profits to buy assets, its common equity increases along with BVPS. If XYZ uses $300,000 of its earnings to reduce liabilities, common equity also increases. Closely related to the P/B ratio is the price-to-tangible-book value ratio (PTVB).

Operating Income: Understanding its Significance in Business Finance

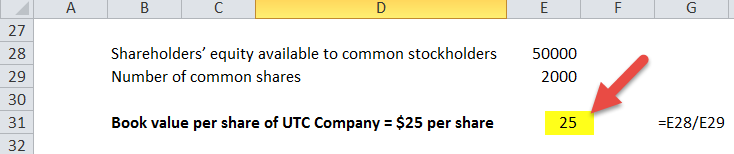

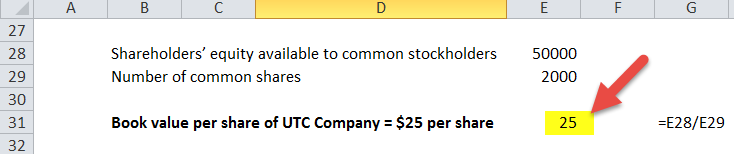

As a result, investors must first determine the market capitalisation of a company by multiplying the current market price of its stocks by the total number of outstanding shares. The price-to-book ratio is important because it can help investors understand whether a company’s market price seems reasonable compared to its balance sheet. To calculate book value per share, simply divide a company’s total common equity by the number of shares outstanding. For example, if a company has total common equity of $1,000,000 and 1,000,000 shares outstanding, then its book value per share would be $1.

Before discussing different factors, it’s important to remember that book value per share is essentially an indication of a company’s intrinsic worth, determined from its balance sheet data. how do i approve bills on xero This intrinsic value reflects a company’s net assets after adjusting for its liabilities. To use the formula, first find the total book value and the number of outstanding shares.

Best Penny Stocks Under Rs. 10 – Based on Fundamental Factors

In conclusion, book value per share can hold meaningful implications for a company’s commitment to CSR and sustainability. While the effect of such practices on book value per share may not be immediate, they form an integral part of the company’s long-term value creation strategy. In Mergers and Acquisitions (M&A), book value per share is extensively used in gauging the underlying value of a firm prior to the transition of ownership or amalgamation. Remember, even if a company has a high book value per share, there’s no guarantee that it will be a successful investment. The book value per share is just one metric that you should look at when considering an investment.

Despite the increase in share price (and market capitalization), the book value of equity per share (BVPS) remained unchanged in Year 1 and 2. BVPS is typically calculated and published periodically, such as quarterly or annually. This infrequency means that BVPS may not always reflect the most up-to-date value of a company’s assets and liabilities.

Now, let’s say that XYZ Company has total equity of $500,000 and 2,000,000 shares outstanding. In this case, each share of stock would be worth $0.50 if the company got liquidated. Book value per share is just one of the methods for comparison in valuing of a company. Enterprise value, or firm value, market value, market capitalization, and other methods may be used in different circumstances or compared to one another for contrast.

Book value per share considers historical costs, whereas the market value per share is based on the company’s potential profitability. Book Value Per Share or BVPS is used by investors to determine if a company’s stock price is undervalued compared to its market value per share. To sum up, while both values serve crucial roles in valuation, they offer different lenses to evaluate a company’s worth. The book value per share looks at the company’s value from a liquidation standpoint, while market value per share reflects the value from the viewpoint of the broader investment market.

НОВОСТИ

НОВОСТИ Half-Life

Half-Life Half-Life 2

Half-Life 2