Estimates are adjusting entries that record non-cash items, such as depreciation expense, allowance for doubtful accounts, or the inventory obsolescence reserve. Adjusting journal entries can also refer to financial reporting that corrects a mistake made previously in the accounting period. Some accounting software will allow you to indicate the adjusting entries you would like to have reversed automatically in the next accounting period. If $3,000 has been earned, the Service Revenues account must include $3,000. The remaining $1,000 that has not been earned will be deferred to the following accounting period.

( . Adjusting entries for accruing uncollected revenue:

For the past 52 years, Harold Averkamp (CPA, MBA) has worked as an accounting supervisor, manager, consultant, university instructor, and innovator in teaching accounting online. A financial professional will offer guidance based on the information provided and offer a no-obligation call to better understand cpa networking club of florida your situation. Someone on our team will connect you with a financial professional in our network holding the correct designation and expertise. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications.

Adjusting Entries and Their Purpose FAQs

To begin, the bookkeeper or accountant must identify the need for an adjustment entry. This could be due to an error in the original journal entry, the need to accrue expenses or revenue, or the need to record depreciation. Amortization is the allocation of the cost of an intangible asset over its useful life. To record amortization, an accountant would debit an expense account and credit an accumulated amortization account. This account is a non-operating or “other” expense for the cost of borrowed money or other credit. A word used by accountants to communicate that an expense has occurred and needs to be recognized on the income statement even though no payment was made.

Accounting terms to know

These include our visual tutorial, flashcards, cheat sheet, quick tests, quick test with coaching, and more. Adjusting Entries reflect the difference between the income earned on Accrual Basis and that earned on cash basis. This enables us to arrive at the true result of business activities for a given period (e.G., Whether we made profits or suffered losses).

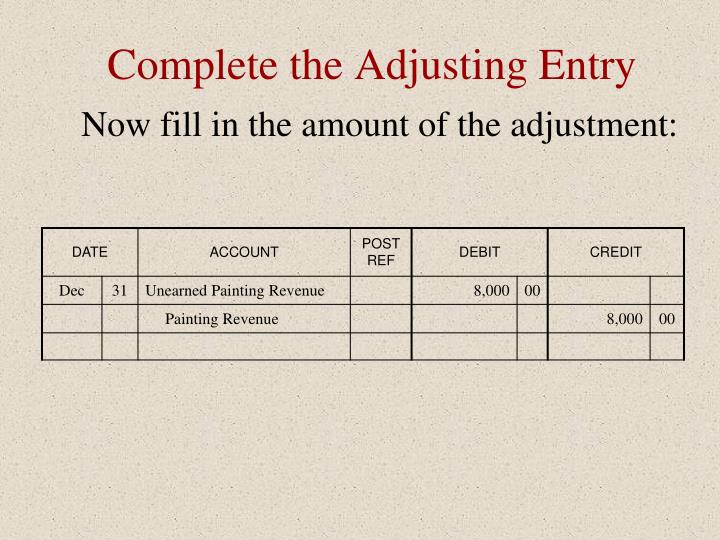

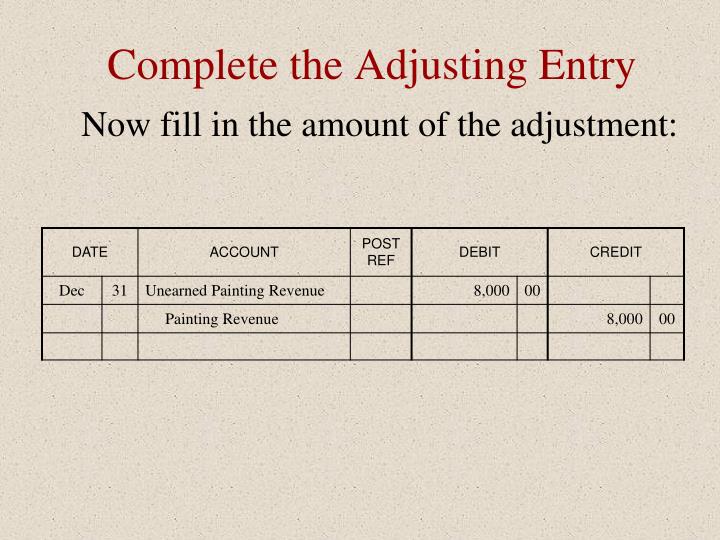

Unearned Revenues

A business needs to record the true and fair values of its expenses, revenues, assets, and liabilities. Adjusting entries follows the accrual principle of accounting and makes necessary adjustments that are not recorded during the previous accounting year. The adjusting journal entry generally takes place on the last day of the accounting year and majorly adjusts revenues and expenses. The five most common types of adjusting entries are prepaid expenses, depreciation, accrued expenses, accrued income, and unearned income.

The amount that is not earned as of December 31 must be reported as a liability on the December 31 balance sheet. An example of an adjusting entry is the accrual of unpaid wages at the end of an accounting period. If a company has employees who have worked but have not yet been paid, an adjusting entry is made to record the amount of the unpaid wages as an expense and a liability. Adjustment entries are made at the end of an accounting period, which can impact the timing of when revenue and expenses are recorded.

- Adjusting journal entries can also refer to financial reporting that corrects a mistake made previously in the accounting period.

- The $600 debit is subtracted from the $4,000 credit to get a final balance of $3,400 (credit).

- Often, prepaid expenses require an adjusting entry at the end of a financial year, and an additional one when the asset’s value has been fully incurred.

- The life of a business is divided into accounting periods, which is the time frame (usually a fiscal year) for which a business chooses to prepare its financial statements.

- The balance sheet dated December 31 should report the cost of five months of the insurance coverage that has not yet been used up.

In October, cash is recorded into accounts receivable as cash expected to be received. Then when the client sends payment in December, it’s time to make the adjusting entry. The primary distinction between cash and accrual accounting is in the timing of when expenses and revenues are recognized. With cash accounting, this occurs only when money is received for goods or services.

Adjusting journal entries are used to reconcile transactions that have not yet closed, but that straddle accounting periods. These can be either payments or expenses whereby the payment does not occur at the same time as delivery. Adjustment entries are an important tool for businesses to ensure that their financial statements are accurate. These entries can impact a business’s cash flow, profitability, stock-based compensation, accounting periods, and fiscal year. Adjustment entries can also impact a business’s profitability by affecting the amount of revenue and expenses that are recorded in a particular accounting period. For example, if an adjustment entry is made to increase revenue, this will increase the business’s profitability for that period.

If the Final Accounts are to be prepared correctly, these must be dealt with properly. First, during February, when you produce the bags and invoice the client, you record the anticipated income. Learn how to build, read, and use financial statements for your business so you can make more informed decisions. Our team is ready to learn about your business and guide you to the right solution. Bench simplifies your small business accounting by combining intuitive software that automates the busywork with real, professional human support.

Similarly, for the company’s balance sheet on December 31 to be accurate, it must report a liability for the interest owed as of the balance sheet date. An adjusting entry is needed so that December’s interest expense is included on December’s income statement and the interest due as of December 31 is included on the December 31 balance sheet. The adjusting entry will debit Interest Expense and credit Interest Payable for the amount of interest from December 1 to December 31. When you make an adjusting entry, you’re making sure the activities of your business are recorded accurately in time. If you don’t make adjusting entries, your books will show you paying for expenses before they’re actually incurred, or collecting unearned revenue before you can actually use the money.

Before making adjustments, it is important to understand first what adjustments are and why they are needed. Get free guides, articles, tools and calculators to help you navigate the financial side of your business with ease. The magic happens when our intuitive software and real, human support come together. Book a demo today to see what running your business is like with Bench. — Paul’s employee works half a pay period, so Paul accrues $500 of wages.

НОВОСТИ

НОВОСТИ Half-Life

Half-Life Half-Life 2

Half-Life 2